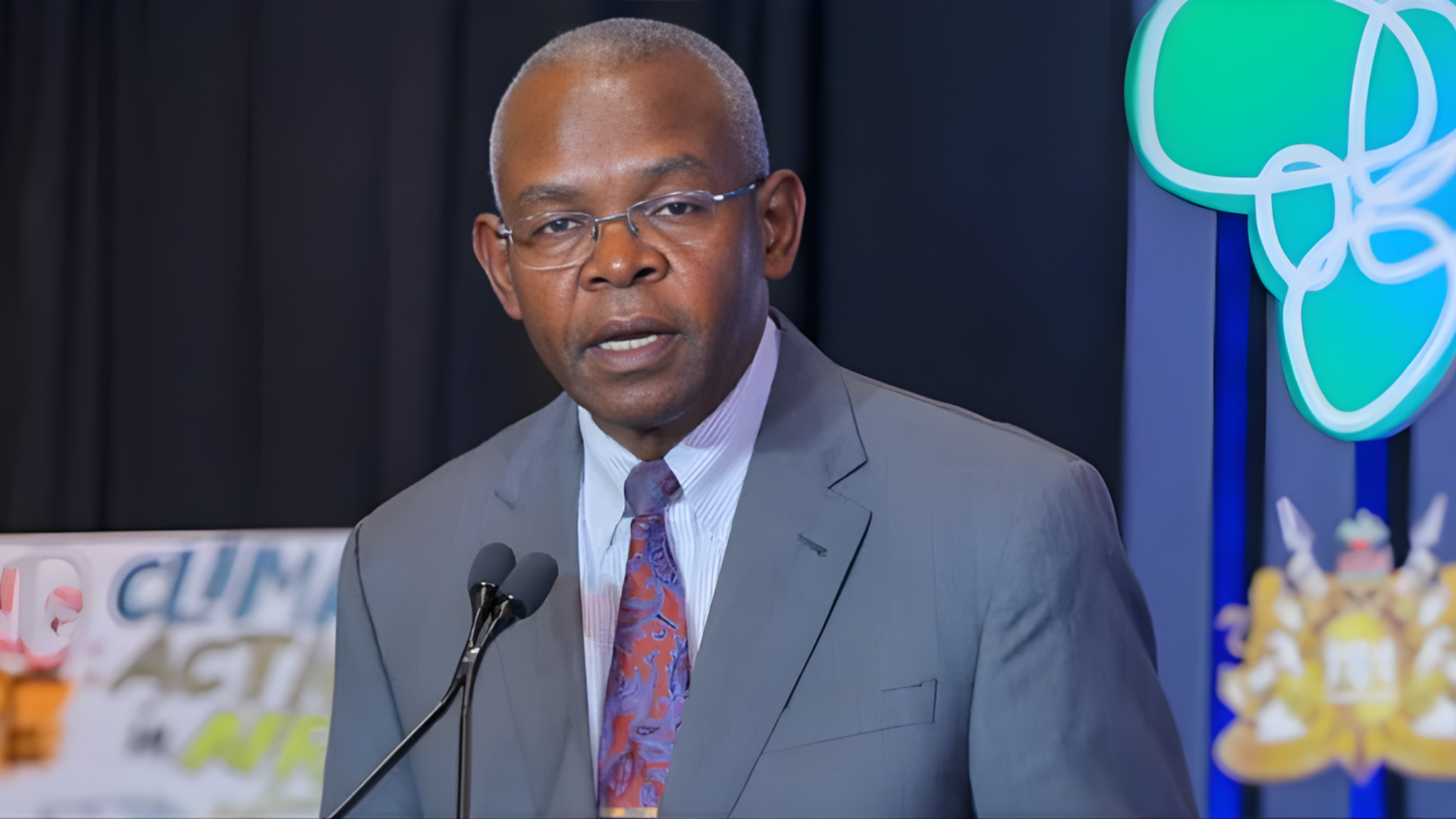

Absa Group has unveiled a major executive leadership reshuffle, headlined by the appointment of fintech heavyweight Sitoyo Lopokoiyit as Chief Executive of Personal and Private Banking, as the bank sharpens its focus on customer-led growth under its refocused Pan-African Strategy.

Lopokoiyit, the former Managing Director of M-PESA Africa and Chief Financial Services Officer at Safaricom, will assume his new role on 1 April 2026. His appointment signals Absa’s intention to accelerate digital innovation, deepen financial inclusion and strengthen its competitive position across the continent.

With more than 12 years of fintech leadership experience, Lopokoiyit played a central role in scaling M-PESA into Africa’s largest fintech platform, serving over 56 million customers and more than 5 million businesses. He led the joint venture between Safaricom and Vodacom with a mandate to expand M-PESA’s reach across African markets, driving product innovation and strategic partnerships.

During his tenure, he spearheaded major initiatives including the launch of the M-PESA Super App, Fuliza overdraft service, and partnerships with global platforms such as PayPal and AliPay — moves that significantly broadened digital payments adoption and strengthened cross-border capabilities.

Absa Group Chief Executive Officer Kenny Fihla said the appointment underscores the bank’s strategic focus on delivering integrated, customer-centric solutions while unlocking new growth opportunities.

“This appointment demonstrates Absa’s commitment to strengthening leadership capability in critical growth areas and delivering innovative solutions that meet the evolving needs of our customers,” Fihla said.

Beyond growth ambitions, the bank also announced key governance and assurance appointments aimed at reinforcing oversight and organisational resilience.

Prabashni Naidoo, currently Group Chief Internal Audit Executive, will transition into a newly reconstructed role as Group Chief Governance Officer, effective 1 March 2026. The expanded portfolio will consolidate Legal, Compliance and Group Secretariat functions under a single executive office, strengthening governance coordination across the Group.

Naidoo brings extensive experience in audit, risk management, regulatory engagement and organisational assurance, and is widely regarded as a seasoned governance professional within the financial services sector.

Rushdi Solomons has been promoted to Group Chief Internal Audit Officer, also effective 1 March 2026. He previously served as Managing Executive: Compliance Strategy, Regulatory Relations and Governance, and before that as Chief Operating Officer in Group Internal Audit. His career includes senior roles at Deloitte Risk Advisory, PwC, and the Auditor-General of South Africa.

In addition, Fatima Newman has been appointed Chief Compliance Officer. With 28 years of experience spanning risk, compliance, regulatory governance and financial services, Newman has held senior leadership positions at Absa, MTN South Africa, EOH Group Limited and EasyHQ. Fihla said the leadership changes reflect both strong internal succession planning and the deliberate introduction of external expertise to close capability gaps.“We are building a future-fit leadership team and deepening our bench strength to ensure we have the right capabilities in place to deliver on our strategic ambitions,” he said.

The appointments come at a pivotal time for African banking, as institutions face increasing digital disruption, regulatory complexity and heightened competition. By combining fintech expertise with strengthened governance oversight, Absa appears to be positioning itself for sustainable growth in an evolving financial landscape.