The vibrant chaos of Gikomba Market in Nairobi, where vendors in colorful kitenges haggle over sacks of tomatoes and bolts of kitenge fabric while their smartphones buzz with M-Pesa beeps for every deal sealed, has long been the pulse of Kenya's cashless economy—a place where a quick tap can turn a Sh200 sale into supper for a family of four. Yet, beneath the surface hum of these digital exchanges lies a sobering reality that has quietly eroded the vibrancy: the value of cash flowing through mobile money agents like M-Pesa and Airtel Money plummeted by a staggering Sh345 billion in the nine months to September 2025, even as the number of users and transaction volumes ticked upward. This historic drop—the largest since M-Pesa's 2007 launch—signals a deeper malaise in household finances, where rising prices and shrinking disposable incomes have forced Kenyans to transact smaller amounts more frequently, turning what was once a torrent of economic activity into a trickle of survival trades. "People are still using their phones to buy unga or pay the kiosk, but the baskets are lighter—Sh500 instead of Sh1,000, because that's all that's left after bills bite deeper," reflected 45-year-old mama mboga Jane Wanjiku as she wrapped a customer's Sh100 purchase in newspaper, her own M-Pesa wallet showing a balance of Sh450 after a morning's sales. "It's not that we're not using it; it's that we have less to use."

Central Bank of Kenya data, released in its November 2025 Financial Sector Stability Report, paints a stark picture of this contraction: mobile money agents processed Sh6.2 trillion in transactions from January to September, a 5.3 percent decline from the Sh6.5 trillion in the same period of 2024. The figure represents the lowest nine-month total since 2019's COVID-induced slump, underscoring a structural shift where volume—1.91 billion transactions, up 2.7 percent year-on-year—masks a value erosion driven by economic headwinds. "The drop in value came despite higher activity at the agent level, with customers carrying out 1.91 billion transactions during the period, a 2.7 percent rise from a year earlier," the report noted, attributing the paradox to "constrained disposable income amid persistent inflationary pressures." Core inflation, excluding volatile food and energy, hovered at 2.2 percent in March 2025 before easing to 1.8 percent by September, but headline inflation remained stubborn at 4.6 percent, fueled by Sh150 per kg maize prices and Sh120 per litre cooking gas that squeezed household budgets by 15 percent year-on-year.

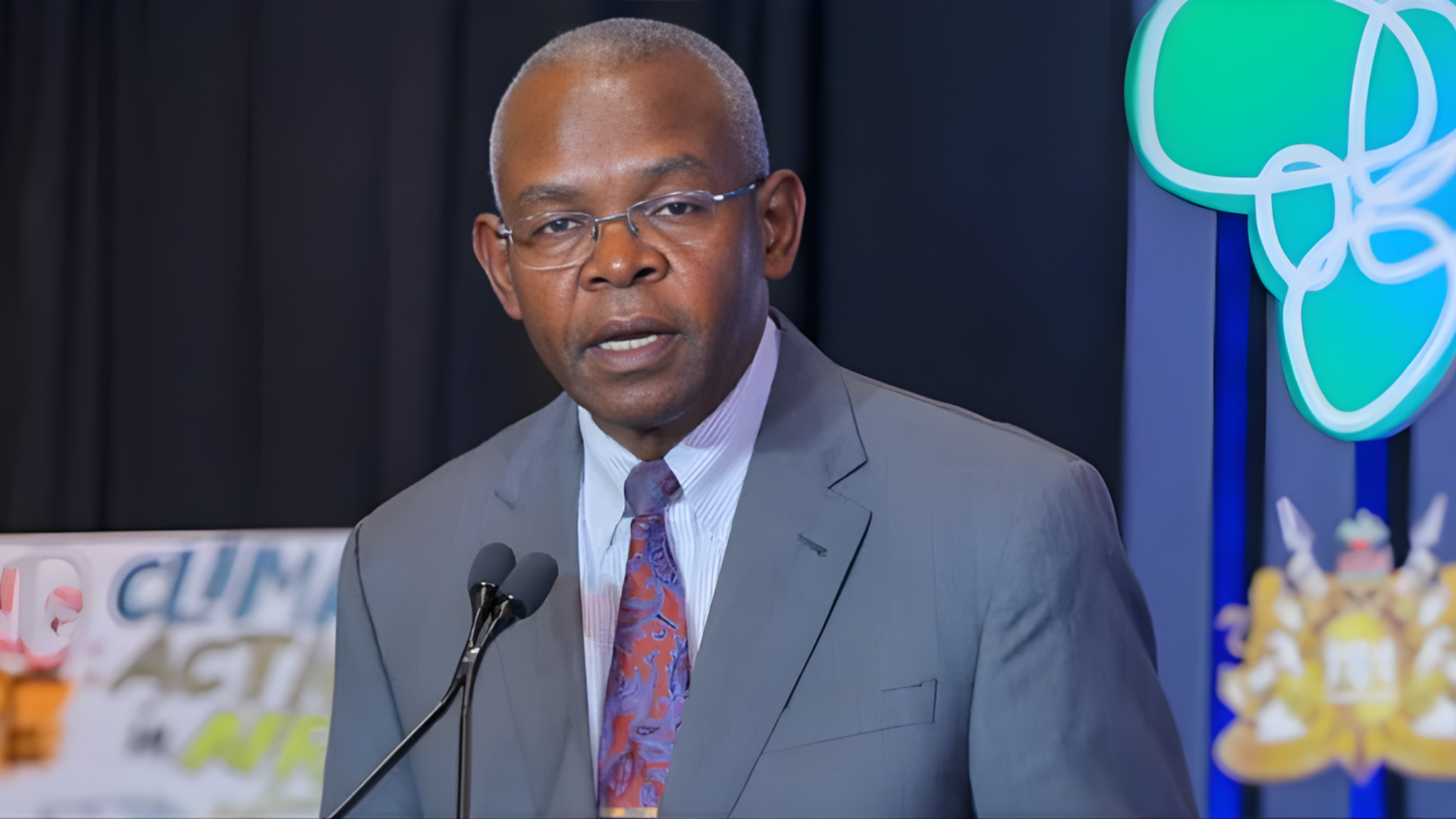

The decline's roots burrow deep into Kenya's post-pandemic recovery, where the 2024 Gen Z protests that toppled the Finance Bill and forced a cabinet purge had unintended ripples: while tax relief saved households Sh50 billion, the ensuing economic uncertainty—coupled with a 5.2 percent GDP growth forecast hampered by Sh10.5 trillion public debt—curbed spending. "Kenyans are transacting more but smaller—Sh200 for airtime instead of Sh500, Sh100 for till payments instead of Sh300," analyzed Dr. Fredrick Onyango, an economist at the Kenya Institute for Public Policy Research and Analysis, during a November 20 webinar attended by 1,500 stakeholders. "It's a survival mode: remittances from the Gulf down 8 percent to Sh4.2 trillion annually, informal sector wages stagnant at Sh15,000 monthly—people use mobile money for essentials, not extras." In Gikomba, Wanjiku's stall exemplifies the squeeze: her monthly M-Pesa inflows fell from Sh120,000 in 2024 to Sh85,000, a 29 percent drop mirroring the national trend.

Mobile money, Kenya's digital crown jewel since M-Pesa's 2007 debut, has woven itself into the fabric of daily life, powering 70 percent of GDP transactions and serving 30 million users through 280,000 agents. Yet, the value contraction signals fragility: September's Sh670.52 billion low, down from February's Sh790.8 billion peak, reflects seasonal dips exacerbated by back-to-school fees and harvest lags. "Men accounted for 61 percent of the mobile money cash transacted through M-Pesa, Airtel Money, and T-Kash," the CBK report highlighted, underscoring gender disparities in spending power amid women's 25 percent unemployment rate. The Economic Survey 2024 noted 2021's 6,868 billion peak versus 2020's 5,213 billion, but 2025's trajectory—projected 8,697 billion full-year—has been derailed by inflation's bite.

Safaricom's M-Pesa, commanding 91 percent market share and Sh161.1 billion in 2025 revenues, feels the pinch acutely: transaction fees, a key profit engine, dipped 19.6 percent year-on-year to Sh636.2 billion by February, per CBK data. "The value drop, despite rising users, points to structural shifts—banks and fintechs like Tala siphoning larger transfers," noted CEO Peter Ndegwa in a November 22 investor call, announcing Sh2 billion in agent incentives to boost volumes. Airtel Money, with 25 percent share, reported similar: "Smaller baskets mean more fees, but less float—agents hold Sh6.2 billion less cash," its head lamented.

The National Financial Inclusion Strategy 2025-2028 aims to counter with 57 percent fee cuts, but 2025's Sh6.59 trillion full-year projection—17 percent down from 2024's Sh7.95 trillion—underscores urgency. "Mobile money expanded access, but economic squeeze squeezes value," GSMA's 2025 report warned, projecting USD 727.7 billion by 2033 but cautioning on inflation's drag.

In Gikomba, Wanjiku adapts: "Sh100 tills more often—mobile money's my ledger, but life's ledger's lean." For Onyango: "Survival transacts small." In Kenya's cashless crossroads, the drop dawns—a digital dip where volumes veil value's void, and resilience remits reduced.

The nine months: Sh6.2 trillion vs Sh6.5 trillion 2024. September low: Sh670.52 billion. February high: Sh790.8 billion. Remittances: Sh651.7 billion 2024, 18% up. Inflation: 3.3% January 2025. Ndegwa's incentives: Sh2 billion agents. GSMA projection: USD 727.7 billion 2033. For Wanjiku: Sh85,000 inflows. In the republic's resilient remit, the plunge pulses—a mobile money measure where less cash crafts caution, and Kenya's economy endures elastic.