Kiharu Member of Parliament Ndindi Nyoro has disposed of 3.08 million shares in Kenya Power and Lighting Company valued at KSh 37.8 million in the six months to June 2025, capitalising on a sharp rally in the utility’s stock price driven by better financial performance and increased dividend payouts.

Filings at the Nairobi Securities Exchange show Nyoro’s direct and indirect shareholding in the listed company dropped from 30 million to 26.92 million shares during the period, with the bulk of the sale executed in May and June when the counter traded between KSh 11.50 and KSh 13.20.

The transactions, disclosed through the Capital Markets Authority’s mandatory reporting framework for substantial shareholders, represent the National Assembly Budget Committee chairperson’s first significant disposal since building his position in the utility between 2021 and 2023.

Market analysts said the timing reflects a strategic profit-taking move as Kenya Power shares gained 82 percent in the first half of 2025, making it one of the best-performing counters on the NSE.

“Ndindi Nyoro has locked in substantial gains,” said Aly Khan Satchu, a Nairobi-based investment analyst. “He bought the bulk of his stake when the price was below KSh 4 during the pandemic years. Selling at an average of KSh 12.27 represents a return of over 200 percent in less than four years.”

Kenya Power reported a net profit of KSh 8.2 billion for the half-year to June 2025, a 158 percent jump from the previous period, fuelled by lower fuel costs, forex gains, and increased electricity sales. The board subsequently recommended an interim dividend of KSh 0.50 per share, the first payout to ordinary shareholders in seven years.

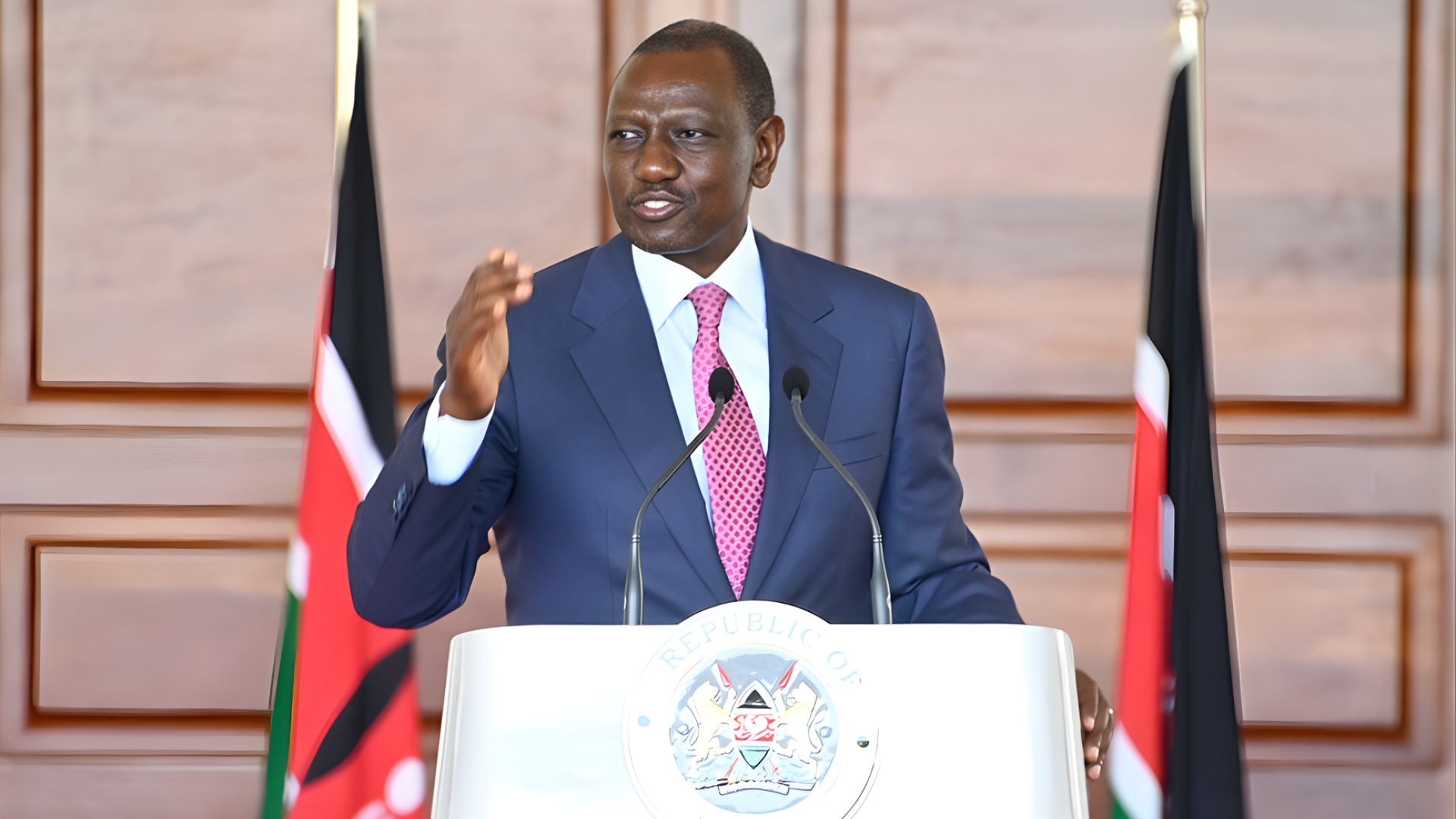

Nyoro, speaking at a funds drive in Murang’a on November 30, 2025, confirmed the sale but described it as routine portfolio rebalancing.

“I have been a long-term investor in Kenya Power because I believe in the turnaround story,” Nyoro told the gathering. “When the share price rises significantly and the company starts paying dividends again, it makes sense to take some profit off the table while retaining a substantial stake for future growth.”

The MP still holds 26.92 million shares worth approximately KSh 331 million at the current market price of KSh 12.30, making him one of the largest individual shareholders in the utility after the National Treasury and the National Social Security Fund.

Market data shows Nyoro began accumulating Kenya Power shares in 2021 when the counter hit all-time lows below KSh 2 amid heavy losses triggered by high fuel costs and dollar-denominated power purchase agreements. His purchases continued through 2022 and early 2023, with disclosures showing he acquired blocks of between 500,000 and 2 million shares at prices ranging from KSh 1.80 to KSh 4.20.

The recent sale reduces his stake from 1.89 percent to 1.69 percent of Kenya Power’s issued share capital of 1.95 billion ordinary shares.

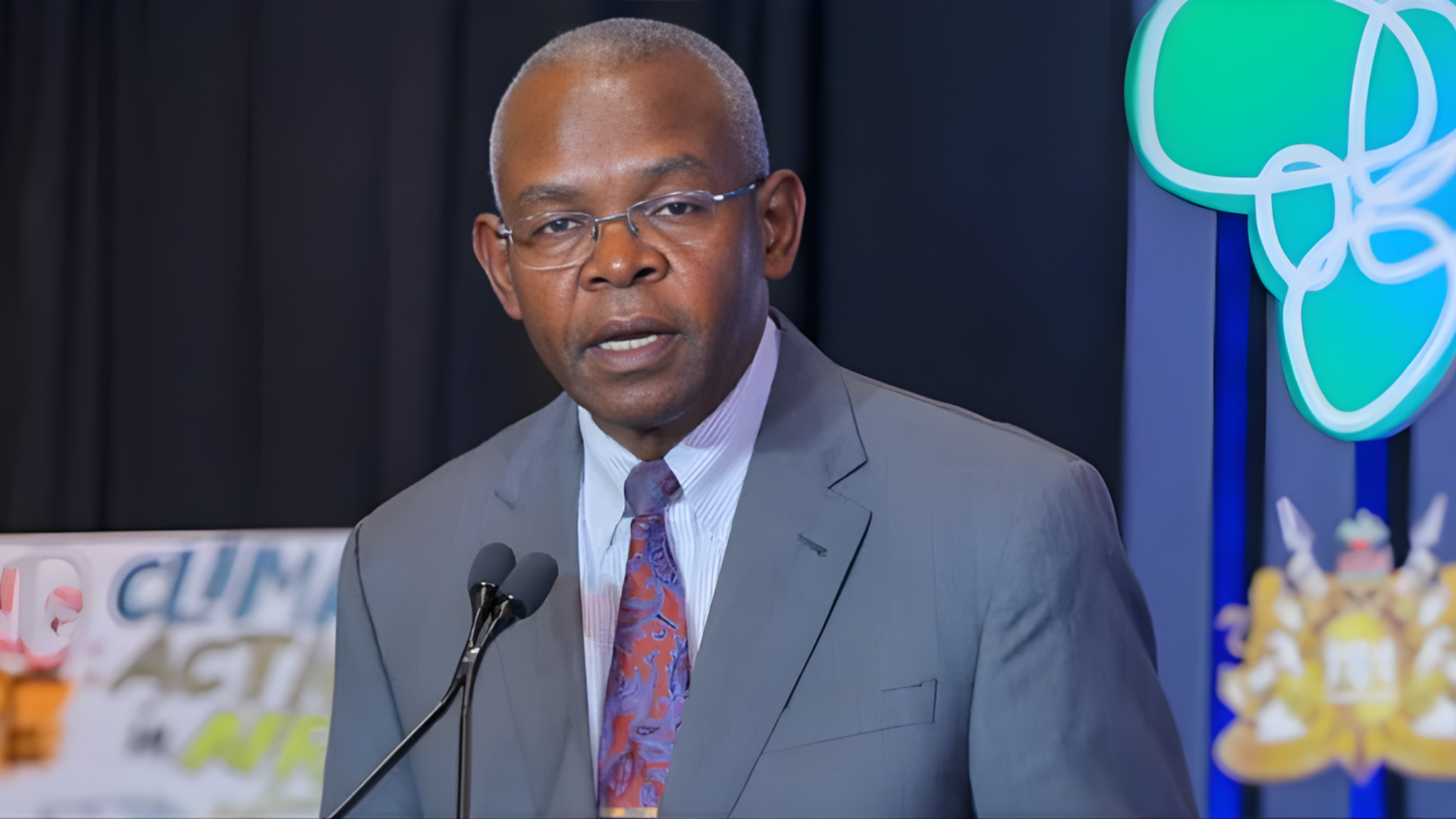

Financial analysts have hailed Kenya Power’s recovery under managing director Joseph Siror, with lower system losses, improved collections, and reduced exposure to thermal power driving profitability.

“The company is now on a sustainable path,” said Rufus Mwanyasi, chief executive of Canaan Capital. “Investors who held through the tough years, like Honourable Nyoro, are being handsomely rewarded.”

Nyoro’s transaction has drawn attention given his influential role as chairperson of the National Assembly’s Budget and Appropriations Committee, which oversees the energy sector’s fiscal allocations.

However, the Capital Markets Authority confirmed the sale complied with insider trading regulations as it was executed on the open market with no access to material non-public information.

The MP said part of the proceeds would fund constituency development projects and youth empowerment programmes in Kiharu.

“Investment is about creating wealth that can then be channelled back to serve the people,” Nyoro told the Murang’a gathering. “These resources will go toward bursaries, water projects, and supporting small businesses in the constituency.”

Kenya Power shares closed at KSh 12.30 on November 29, 2025, giving the company a market capitalisation of KSh 24 billion.